do you pay sales tax on a used boat in florida

Depending on the boat you buy or what your boat comes with you will pay a 2 or 4 sales tax. Floridas 6 sales tax applies to all boats with a maximum tax of 18000 on the sale or use of any vessel.

Sales Tax On A Boat Can You Avoid It

The absolute maximum tax you can pay on the sale of a boat or vessel in the state of Florida is 18000 as of 2018 state tax rates.

. When it comes to flat rates the North Carolina sales. For instance assume you paid tax on your 100000 boat purchase to your home state at a 6 rate or 6000. State B welcomes you to the state but.

561-799-6511 Monday Friday 830 AM 5 PM. If you buy a sailboat alone it can be. You can register using the online registration system or submit a paper Florida Business Tax Application Form DR-1.

Another very good option to avoid initial sales tax is to identify an escape clause in your local tax jurisdiction. This figure includes all sales and use tax plus. Florida requires anyone buying a boat from a dealer.

You may find businesses purporting to help you avoid the sales tax on your boat purchase. You decide to take your boat to State B. So you as the buyer will only pay sales tax on the boat itself to the DMV.

Boats must be registered in order to be legally used in the ocean. You would pay 23500 for the vehicle. Businesses must register each location to collect report and pay sales tax.

The sales and use taxes on. The absolute maximum tax you can pay on the. If youre in the market for a boat valued at 300000 or more.

There are several options as to how a buyer can avoid sales tax. Of course the simplest method is to purchase a boat in a nontaxing state such as Delaware or Rhode Island. Well explain all you need to know about Florida sales tax and outboard engines.

So for example if your bill of sale reflects 250000 but 75000 is separately itemize for the two 250. Floridas Sales Tax Applies to Boats. So at the end of the day.

For instance a boat trailer sold alone is taxable at 2. In Maryland for example one need not pay sales tax on a boat that. New Yorkers for instance pay sales tax on only the first 230000 of a purchase priceor 825 percent in most counties.

Before you purchase a new or used vessel consult with your experienced Florida boat buying attorney we are ready to take your call. This help is never free and is misleading.

Florida Boat Registration Numbers Stickers Ace Boater

Vehicle Sales Purchases Orange County Tax Collector

Boat Trailer Registration In Michigan The Sam Bernstein Law Firm

Miami Mansion Owners Say House Is A Boat For Tax Purposes

9 Things To Consider When Buying Or Selling A Yacht In Florida

7 Questions To Ask Yourself Before Buying A Boat On The Water

Jet Boats For Sale In Florida Jet Boat Dealership

7 Questions To Ask Yourself Before Buying A Boat On The Water

2022 Tax Free Weekend In Florida 4 Weeks You Can Save Money

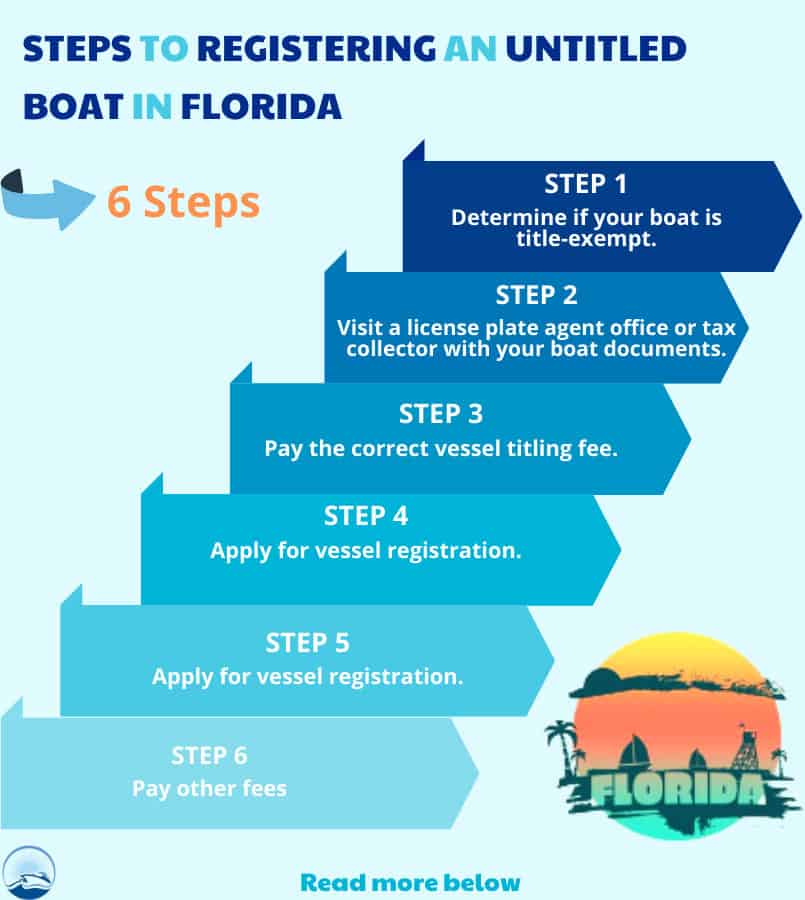

How To Register A Boat In Florida With No Title In 6 Steps

What Boat Buyers Should Know About Florida Sales Tax Law Macgregor Yachts

Sales Tax On A Boat Can You Avoid It

How To Register A Boat In Florida With No Title In 6 Steps

How To Register A Boat In Florida With No Title In 6 Steps

Pontoon Boat Rental Tampa Bay Area Canoe And Kayak Rentals Pasco County Tiki Bar Booze Cruise Clearwater And St Petersburg Florida Best Pontoon Boat Rental St Pete Beach

Pontoon Boat Rental Tampa Bay Area Canoe And Kayak Rentals Pasco County Tiki Bar Booze Cruise Clearwater And St Petersburg Florida Best Pontoon Boat Rental St Pete Beach